Investment update – the financial year that was

One for the record books

There’s no doubting the financial year to 30 June 2020 will go down in the history books. The period started with share markets struggling to make headway from July to September in the face of US-China trade tensions.

But late 2019 saw share markets rally as central banks put the pedal to the metal on monetary policy and US-China trade tensions started to ease.

The U-turn got a further boost in January when the US and China negotiated a ‘Phase 1’ trade deal. An all-out trade war was avoided.

But along came a small threat called COVID-19. We say small because global share markets initially brushed off the threat of COVID-19. The virus first appeared in China in late 2019 but many share markets reached new highs by late February despite this.

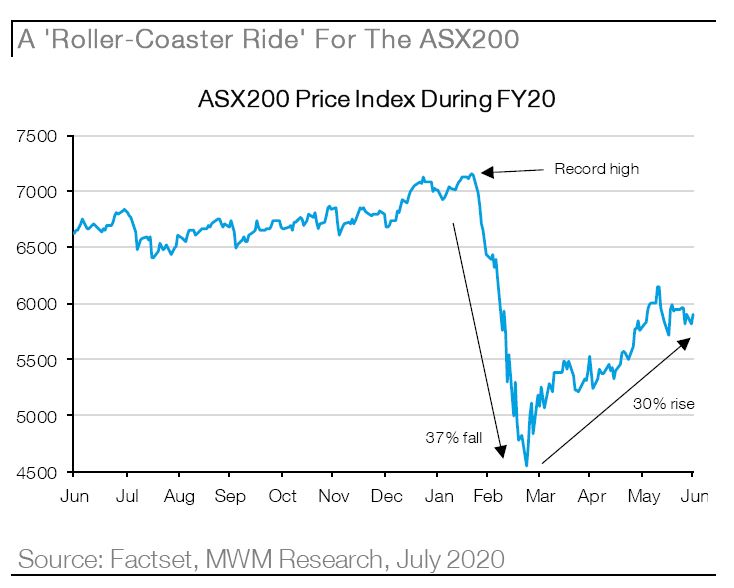

The record highs and easing tensions with China didn’t last long though. We watched with disbelief as COVID-19 escalated into a global pandemic. Growth assets like shares began selling off rapidly.

And the month of March saw the quickest share market sell-off in history as one country after another chose to shut down large parts of their economy.

Investor appetite for risk went due south to levels not seen since the Global Financial Crisis in 2008. Politicians & central bankers responded with a ‘whatever it takes’ approach in the form unprecedented fiscal and monetary measures.

Several rounds of spending initiatives were enacted, and central banks hit go on new monetary policy measures and lower interest rates.

From 30th June 2019 to 30th June 2020 the RBA official cash rate fell from 1.25% to 0.25% and the US Fed Funds rate fell from 2.25-2:50% to 0.00-0.25%. They remain at these levels with but the only likely trajectory toward zero.

The swift action stemmed the share market losses though and restored some confidence in the economy and financial system. Share markets bottomed in late March and began a sharp rally. The rally gathered steam as the intensity of the virus melted and economies began re-opening. It was too good to be true though.

The rally lost steam in June as a ‘second wave’ of the virus, particularly in many U.S. states, put hopes for a quick economic recovery under threat. And political risk flared up again after China approved a national security law for Hong Kong. The United States responded by revoking the special treatment extended by law to Hong Kong.

Australia weathered the storm relatively well. Like other Western countries, Australia felt the impact of COVID-19 as it introduced lockdowns and travel bans. However, the progression of the virus was well contained. The Australian economy was hit much less than other major Western economies.

In addition, the Australian government’s fiscal response as a percentage of GDP was one of the largest in the world, helping to ease the pain on the economy.

The ‘roller coaster’ ride for shares through the financial year resulted in major differences in performance at both a market and sector level.

International shares posted an aggregate total return of around 4% in local currency. However, US equities (+7.5%) substantially outperformed other major markets, some of which (Europe -4.5% and UK – 13.8%) underperformed heavily.

The best performing sector (Information Technology) rose around 30% while the worst performing (Energy) fell around 30%. Financials (i.e. Banks) and Listed Property Trusts also performed poorly. Property was weighed down by the closures of retail malls and office buildings.

As always, Australian equities (-7.7%) substantially underperformed despite a relatively less severe progression of the virus. Australia’s underperformance is a function of it sector mix. We have high exposure to underperforming Banks and little exposure to outperforming Tech stocks like Amazon.

Dividend paying shares also underperformed as the economic shutdown hit the cashflows of companies and forced them to slash dividends. The impact of this has been felt by many retirees in Australia where there is a strong appetite for dividend income and franking credits.

While the short-term outlook looks far from rosy and the momentum of the recent rally is likely to fade, we do not think a recovery is at threat. Downside risks are more likely to slow the recovery rather than put the recovery on hold, or worse, reverse it.

This could lead to a more drawn out rebound, but if economic growth and corporate earnings continue a path back to trend, then a combination with record low interest rates should be enough to push markets higher.

Retirees should be prepared for the rally to slow down and for shares to consolidate rather than undergo a major correction. Further COVID-19 outbreaks, especially in Melbourne, are troubling. But they’re already being dealt with in a different manner to the first wave and in a less disruptive way to the economy. For example, locking down specific suburbs rather than the entire state.

A swift economic recovery may have been thwarted but it remains on track despite fear mongering in the news media and record new cases of coronavirus in Victoria.