The RBA leaves rates on hold

The RBA has decided to leave the cash rate at its current levels. This may leave our home loan lenders in a bit of a quandary. All four majors have recently commented that they need to gain some profit margin due to their rising cost of funds. This move by the RBA may force the banks to increase our current rates despite the RBA’s decision to hold. We will wait and see.

Interestingly, ANZ in an attempt to break away from the media’s expectation that they “always match the RBA decision” have decided to review their rates on the second Friday of every month. In response to this move we have already heard another Bank comment that they will simply “wait to see what ANZ does every month”. I’m pretty sure that is not the outcome ANZ was looking for.

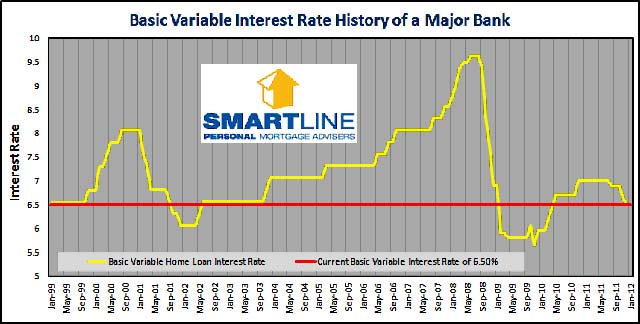

I thought it might be worth showing you our long term variable interest rate chart to provide a sense of positive perspective. The red line represents the current variable interest rate. The yellow line represents this bank’s historical variable interest rate. As you can see, the yellow line rarely dips below our current variable rate. In fact, variable rates have only been lower than current levels for 2.5 years out of the last 13 years.

If you would like to review your existing home loan to make sure you are not paying too much, take advantage of our free home loan review by clicking here.

Source: Smartline