Investment Market Update – 2024

Against a backdrop of high (but reducing) inflation, evidence of a “soft-landing” and the beginning of a global interest rate easing cycle, 2024 proved to be another strong year for equity markets.

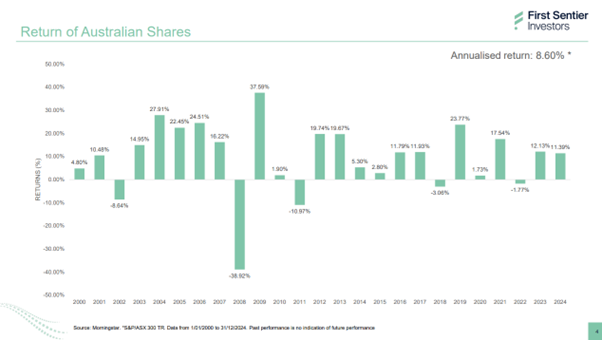

Australian Shares

For the first time since 2016-2017 the Australian sharemarket produced back to back double digit returns (refer chart below). Australian shares produced an 11.39% return for 2024. Although the bank sector sold off in December it managed to return 35.6% for the year. Insurance, retailers, diversified financials, Real Estate Investment Trusts (REITs), utilities, and industrials also managed strong returns for the year. The only laggard were materials (mining) shares that were negatively affected by the slowing of the Chinese economy.

The chart below shows the annual returns of the Australian Sharemarket (ASX300) since 2000.

Global Shares

Notwithstanding a modest sell-off in December, global equities returned 31% for the year in $AUD terms. This was led by the US sharemarket which produced an exceptional 57% return for 2024 on the back of technology and AI related shares such as Nvidia, Apple, Amazon and Alphabet (Google).

Interest Rates – Will They Rise or Fall?

Inflation in Australia showed signs of easing during the final months of 2024, with the trimmed mean inflation rate falling to 3.2% in November, down from 3.5% in October. The RBA held the cash rate steady at 4.35% during its December meeting, however, in positive news for mortgage holders, they decided to cut the cash rate by 0.25 percentage points to 4.10% earlier this month. Most analysts are predicting further cuts later this year, though there is a lot to play out in this space.

Wondering how interest rates might impact your investment portfolio? Read our article here

Stock Market Outlook

Analysts caution that 2025 may bring volatility, driven by geopolitical risks, fluctuating commodity prices, and uncertainty in monetary policies. Already in 2025 we’ve seen Donald Trump start a trade war with his closest neighbours (Canada and Mexico) only to seemingly back down and delay the start to the proposed 25% tariffs. What the US President does is anyone’s guess so Muirfield will be exercising caution with investment strategies in 2025.

Despite the likely volatility, most experts are predicting a solid year on sharemarkets worldwide on the back of reducing inflation, reducing interest rates and a strong workforce.